About Opening An Offshore Bank Account

Table of ContentsThe 20-Second Trick For Opening An Offshore Bank AccountGetting The Opening An Offshore Bank Account To WorkThe Best Guide To Opening An Offshore Bank AccountWhat Does Opening An Offshore Bank Account Do?

The nine largest financial institutions and also constructing cultures in the UK have accepted use fundamental financial institution accounts without any monthly fees to those that: no checking account; have a savings account somewhere else, yet intend to alter carrier; have a financial institution account, yet are in financial trouble and also want their financial institution to open up a brand-new, practical account for them.If you stay in a nation that's part of the EU or European Economic Location (EEA), several financial institutions will let you open up an existing account online without a UK address. This includes Lloyds Bank, which requests for proof of ID and EU address to be sent out by message (the initial papers, not copies, which will certainly be retuned safely).

Others will certainly do an ID check for both of you online. Below's an useful list of the details you may be asked to offer: You'll additionally be triggered to review the personal privacy plan as well as grant your details being held by the bank or structure society as well as shared with credit rating referral companies.

You have a right to your purchase history for as much as 5 years after you have shut your account, many thanks to guidelines established by the Competitors and also Markets Authority (CMA). Switching a bank account For the most part, it's a lot easier to switch over to a new carrier utilizing the Bank account Switch Service (CASS) which intends to shut your old account and also transfer all of your repayment setups within 7 working days.

The Basic Principles Of Opening An Offshore Bank Account

If you do not desire to shut your old account, you can select a partial switch rather than a full switch. This is still an automated procedure and also should still be finished within 7 working days, however you aren't covered by the solution warranty and also deals will not be redirected. Financial institution accounts and also probate: shutting an account on death Once the death has been signed up, the computer registry workplace will release a fatality certificate this is required by financial companies and also federal government departments to settle the events of the deceased.

You can usually shut an account without experiencing probate if the overall balance is listed below a certain limit (see table below). If the total funds surpass this limit, the bank will ask to see a main file called a 'give of probate', or 'letter of management' in Scotland, to show that you deserve to manage their affairs.

/182975194-56a0664c5f9b58eba4b043bc.jpg)

To use for an existing account at the Blog post Office you can see your neighborhood 'Crown' branch these are usually the major article office in an area. If you live or function in an area where a credit score union runs you could be qualified to join. Some credit scores unions supply current accounts similar to fundamental bank accounts.

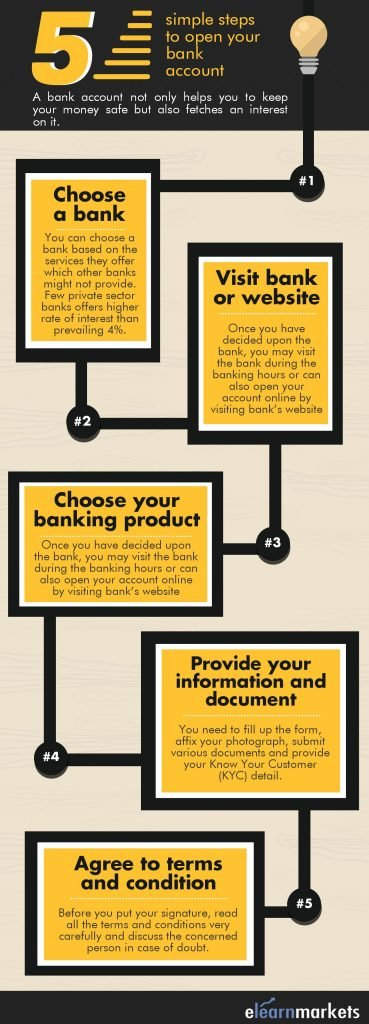

Once you choose a financial institution and also submit some documents, you can entrust to a functioning account. The procedure can get a bit extra challenging because you typically have to supply documents to confirm your identity. It can obtain frustrating and also delay your capability to utilize the account if you don't provide the right documents.

All banks need that account owners go to least 18 years of ages, although a lot of permit a minor to be provided as a joint account find out here now holder with a parent or guardian. A financial institution may turn you down if you have actually criminal convictions connected to scams or monetary crimes or if another financial institution shut your account due to read more mismanagement, such as overdue over-limits. opening an offshore bank account.

While not all financial institutions need every one of these documents, it is far better to have them with you also if you don't require them. Government-Issued Recognition Practically every bank requires you to offer a legitimate government-issued picture ID when opening up a checking account. This verifies that you are that you say you are and also permits the financial institution to match your name to your face - opening an offshore bank account.

All About Opening An Offshore Bank Account

If you don't drive, head to your department of motor vehicles (DMV) and get a state-issued ID. Unlike a motorist's certificate, you do not need to pass a test so as to get one. Just see to it you bring your birth certificate or legitimate passport and evidence of address with you to the DMV.

Or else, bring evidence of your ITIN. If you do not have either, make sure to obtain an ITIN prior to mosting likely to the bank to open your account. You can do so by filling up out as well as submitting Type W-7 to the Internal Earnings Solution (INTERNAL REVENUE SERVICE). Bear in mind, it can take several weeks to get it.

While a few financial institutions allow you to open a checking account making use of a blog post office box, the majority of need that you consist our website of a physical address on the account. The finest means to prove your address is by generating a current official file with your name and address. Your most recent utility bill, cable television expense, bank card statement, or perhaps a cellular phone costs must be enough.

Other alternatives to prove your address consist of a current home mortgage declaration or a lease contract signed by you and also your property owner. Special Factors To Consider Pupil Accounts If you're opening a student account, the financial institution might also call for evidence of registration at a competent school. Student accounts feature reduced or no fees and may additionally have other perks, such as affordable prices for charge card as well as other financial debts.